Pro-People: India Approves Major GST Reforms, Cuts Tax on Daily Goods, Medicines, Cement and More

India’s Goods and Services Tax (GST) Council has approved a sweeping set of tax reforms aimed at reducing costs for consumers and simplifying the indirect tax regime.

The measures, announced after the 56th meeting of the GST Council in New Delhi, include rate cuts on essential medicines, household items, food products, vehicles, and building materials.

|

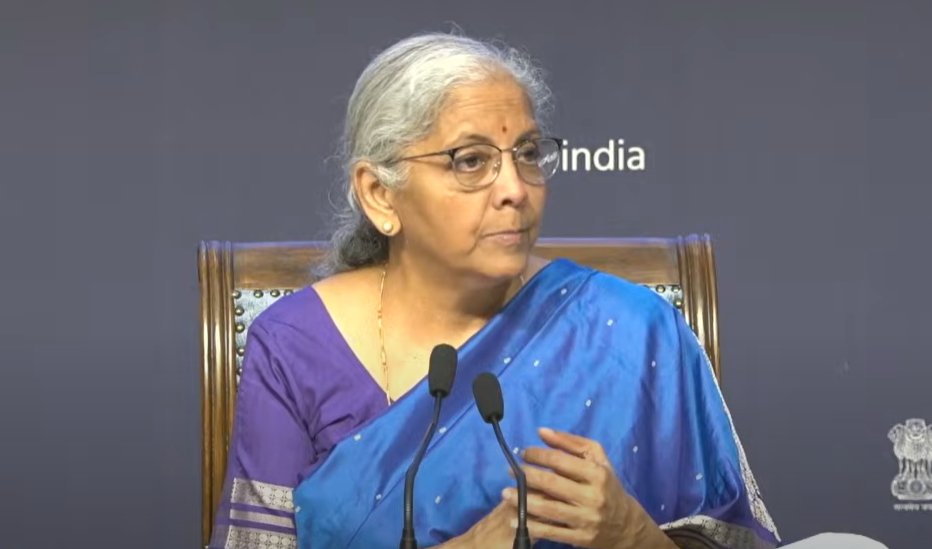

| Image Source: Screengrab PIB Broadcast |

Finance Minister Nirmala Sitharaman, who chaired the marathon 10.5-hour session, said the reforms were consensus-driven and aimed at correcting anomalies in the current multi-tier structure.

Among the most notable changes is a reduction of GST from 12% to 0% on 33 life-saving drugs, including those used for cancer and rare diseases. Spectacles and goggles will now be taxed at 5%, down from 28%.

Essential agricultural equipment such as tractors, threshers, and composting machines will see GST reduced from 12% to 5%, along with bio-pesticides and natural menthol.

Labour-intensive sectors like handicrafts, leather goods, and building stones such as granite and marble blocks will also benefit from tax cuts.

GST on cement has been reduced from 28% to 18%, addressing a long-standing demand from the construction industry.

Three-wheelers and small automobiles (up to 350cc) will also be taxed at 18% instead of 28%.

Consumer goods like air conditioners, large-screen televisions, and dishwashers will shift to the 18% bracket.

Daily-use products including hair oil, soaps, shampoos, bicycles, and toothbrushes will now attract a uniform 5% GST.

A 0% tax rate has been approved for Indian breads (roti, paratha), paneer, and ultra-high temperature milk.

On the food front, packaged items such as namkeen, sauces, noodles, coffee, cornflakes, and chocolates have moved to the 5% slab from the previous 12%–18% range.

At the structural level, the Council approved a two-tier rate system of 5% and 18%, replacing the previous five-slab structure.

A separate “special slab” will apply to demerit goods, including tobacco, pan masala, and aerated drinks, which will attract rates up to 40%.

Finance ministers from states including Uttar Pradesh, Assam, Punjab, and Bihar expressed support, though some flagged concerns about compensation cess and revenue shortfalls.

West Bengal’s finance minister estimated the total revenue impact at ₹47,700 crore.

The new rates will come into effect on September 22, 2025.

This is a developing story and may be updated.